Late spring is my favourite time of year. I love the smell of buds and blossoms in the air, and I am fascinated at how a seed becomes a beautiful plant in a short time. Philanthropy can be much the same. You can take a small amount of money and turn it into a significant gift – making beautiful opportunities blossom.

Life insurance is an often overlooked vehicle for making a big philanthropic gift. Many clients include charitable donations in their estate planning and you do not need to be wealthy to create a positive impact. Every person has the ability to be a philanthropist. Donating a policy allows an individual or a corporation to make a maximum gift for minimum cost. In very simplistic terms, $2 to a charity equals $1 of tax saved personally, and $1 to a charity equals $1 of tax saved corporately.

Here are a few ways life insurance can be used for charitable donations.

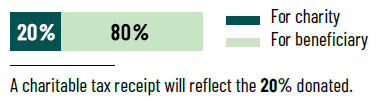

1. Split the beneficiary on an existing policy – keep 80 per cent (or some percentage) for your intended beneficiary and divert 20 per cent to your favorite charity (the policy must have been in place for a few years).

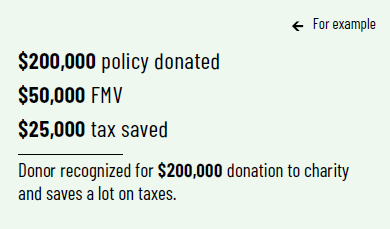

2. Donate an existing policy – if you no longer need a policy, consider donating it. Have the policy valuated for fair market value (FMV), receive charitable tax receipts for the FMV, as well as future premium payments.

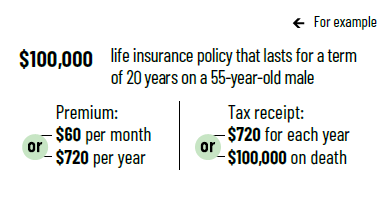

3. Donate a new policy – The same money paid each month creates a greater impact. Want to turn $60 a month into $100,000? The donor must decide if they want the ongoing annual premium tax credit or the larger tax credit upon death.

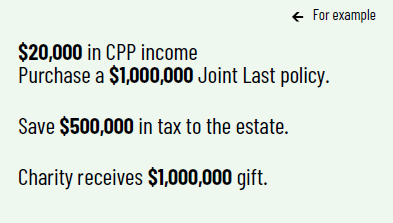

4. If CPP income is not needed for lifestyle, use those funds to pay the premium on a new policy owned by the charity, with the charity as the beneficiary. This saves the tax on CPP income as it becomes a charitable donation and leaves a large donation legacy. As well, you can take the CPP funds, pay the personal tax and purchase a policy that is donated by the family’s estate on death.

5. Donate a policy that would otherwise lapse. Term insurance can become prohibitively expensive as you age. Consider having the policy valuated, donate it to a charity and receive a tax receipt for 10 to 50 per cent of face amount. The charity continues to pay the premium. You are recognized for the gift.

Kelly Cyre is an entrepreneur and insurance advisor at Clark Insurance Advisory.